Let’s meet Cladogh Ryan MD, one of the new board members for DPC Alliance for 2021 who picked up the torch from some of those golden oldies.

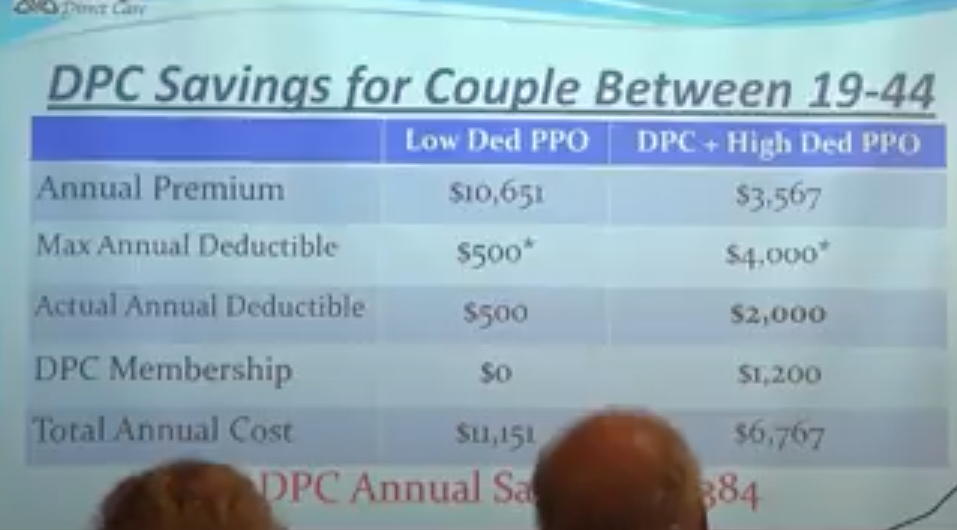

Dr Ryan cranked up a town meeting style event to recruit some of her Cook County, IL, fee-for-service patients into her new enterprise, Cara Direct Care. She layed on a familiar pitch: “Pay me more, it will cost you less.” In this case, $4,384 less per couple!

Here’s the key content from the video of her 2017 presentation, still proudly displayed on YouTube and on Cara Direct Care’s current homepage.

Really? Taking on an additional $3500 in deductible in 2017 cut insurance premiums by over 66% — by over $7,000 for a young couple in the middle of a 19-44 years old range?

No, it didn’t. It’s not even close.

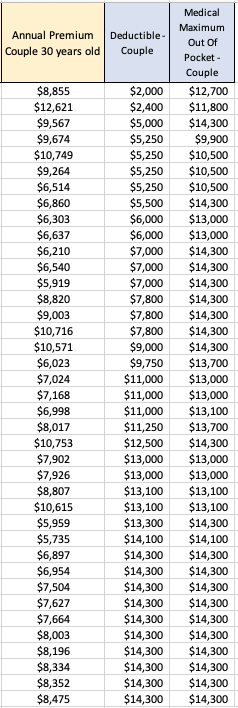

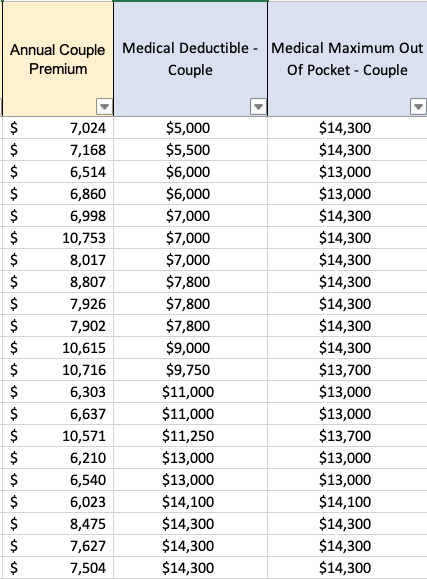

In the real world outside Dr Ryan’s town hall, the premium spread between otherwise similar plans that differ only by a low versus high deductible was slightly over ten per cent for employer sponsored coverage, per Kaiser’s Employee Health Benefits Survey. In the ACA individual market for 2017, when Ryan made her presentation, the premium spread in her own Cook County, IL, between the policy with the lowest deductible policy and an otherwise similar policy having a $3500 larger deductible was less than 20%. See for yourself,**

The supposed point of Dr Ryan’s patient pitch, of course, is that the alleged premium spread of 66%/$7084 is sufficient to cover her proposed DPC fees, and other expectable costs, and still leave thousands in resulting savings. But the real premium spread was nowhere near $7K. At 2017 pricing levels in the ACA market in Cook County, that spread was under $1700 for a couple in the age bracket Ryan discussed. Her 2017 DPC fees swallowed over two-thirds of it.

Doc Ryan’s analysis began with a premium spread error of over $5,000 for the couple. Yet, even with the head start of a $5K falsehood, Dr Ryan ended up computing typical “DPC savings” of only $4384 for that couple. With real premium numbers, Dr Ryan’s own computation means a loss on DPC, not a savings. Dr Ryan’s analysis is nonsense.

By the way, the cheapest policy in the 2017 individual marketplace for a 21 year old couple near the bottom of Ryan’s range of 19-44, $5308 per year, about $2000 and 50% higher than the figure used by the good doctor for a presumably typical HDHP policy.

I decline to accuse Dr Ryan of addressing her potential patients in bad faith in 2017. But DPC thought leaders seem almost never willing to critically examine DPC-favorable information when it comes along. And, no response has been received from Dr Ryan to dpcreferee.com’s request for her comments on the material developed for this post.

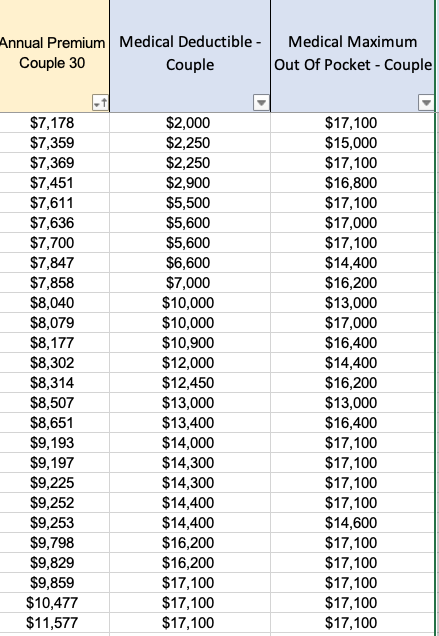

** Here are tables of relevant offerings in the ACA individual market, for Cook County IL as follows: 2017, all policies; 2017 all silver policies; 2020 silver policies. All are sorted by deductible.

Note, for example, that in the current ACA individual market, the difference between a silver plan with the smallest deductible ($2000) and a silver plan with the maximum allowable deductible of $17,100 is less than $2681 — that’s a deductible spread of $15,000 (more than four times as large as Dr Ryan’s $3500), priced at a 27% premium spread (well less than half the 66% Dr Ryan’s calculation used.)