The Milliman team readily admitted that it was unable to assess the impact of DPC on specialist utilization. Then, it overvalued DPC contracts using exactly such an assessment.

DPC advocates broadly insist that DPC members have significantly lower utilization of specialist physician services than do patients who receive primary care under the traditional FFS model. The team from Milliman that conducted the first, and to-date only, published case study of DPC by bona fide actuaries had something truly important to say on that subject .

The medical claim data was not well populated with provider specialty codes. Without this data, we were unable to consistently distinguish between primary care and specialist physician office visits and thus were unable to assess the impact of DPC on physician specialist utilization rates.

Milliman report, page 48; see, also, near identical admission at page 55.

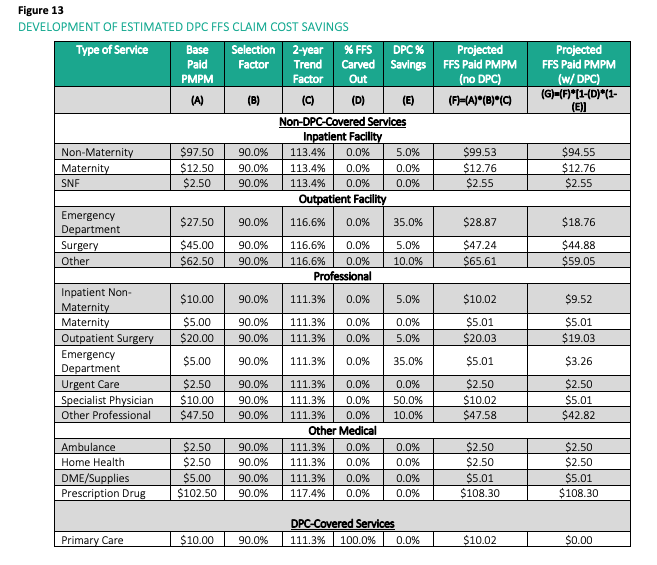

Elsewhere in their report, the Milliman team provided “a generalized actuarial framework that could be used to determine the feasibility of savings for employers”, purportedly based on the case study data. The core of that framework was presented in the following table.

Thus, and despite Team Milliman twice admitting its inability to assess that very question, the line item in the above table that shows the largest “DPC percentage savings” — 50% — turns out to be for specialist physician services. That value is put forward without any attempt to explain how Team Milliman came up with a value that it denied being able to calculate.

A Literature Review section of the Milliman report did briefly present a claim — from a study without risk-adustment — that a now-defunct DPC, Qliance, had produced certain modest reductions in specialist visits; the Milliman report also repeatedly cautioned that data not adjusted for risk likely overvalued DPC effectiveness. And, even at its face-value, Qliance’s claimed savings was a mere 14%, more than three-fold lower than the 50% Team Milliman had, without explanation, inserted into the “actuarial framework”.

As it happens, specialist physician services are a relatively small part of the whole, so that Milliman’s gratuitous inclusion of 50% savings amounts to overvaluing DPC service by a mere $5 PMPM.

In addition to the Case Study and the Literature Review, the Milliman report also contained a Market Study. Milliman’s actuarial framework for employer DPC was apparently sculpted using admittedly “loose” reliance on the Case Study data to demonstrate that an employer could “break even” on a DPC option by contracting with a DPC provider at DPC monthly PMPMs that closely matched the actual DPC monthly fees reported in the Market Study. The $5 PMPM of apparent overvaluation of DPC savings for specialist physician services facilitated that happy coincidence.

The target for monthly DPC fees under Milliman’s framework rounds out to a $60 PMPM composite (based on $75 per adult and $25 per child). I would strongly advise employers are both considering a DPC option, while hoping to break even, to decline any proposal that sets DPC fees at more than $55.

I urge readers of this post to review my blog’s other assessments (summarized and linked here) of the various strengths and weaknesses of the Milliman DPC report. While I take issue with selected aspects of the piece, including at least one of its principal conclusions, I nonetheless find the report serious, well-intentioned, generally careful, and helpful, as befits its place as the first, and to-date only, study of DPC by qualified actuaries.