Note: revised and redated for proximity to related material. Original version June 27, 2020.

In June of 2020, Nextera HealthCare had a hot new brag:

These results were not risk adjusted. But they desperately needed to be.

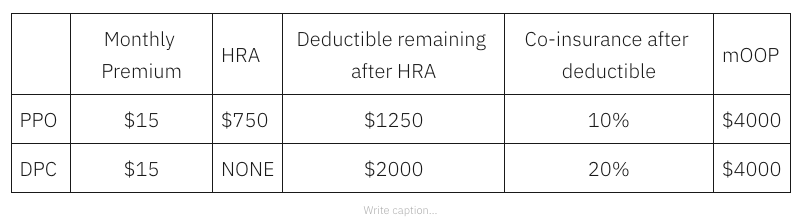

The St Vrain Valley School District had this health benefit structure for its employees during the period studied:

The school district’s 10% coinsurance rate for the PPO predates the arrival of the Nextera option. The school district also has a Kaiser Permanente plan that includes 10% coinsurance. The school district created the unique 20% coinsurance rate for Nextera DPC patients to help fund the added primary care investment involved. Here’s how that benefit structure impacts employees expecting various levels of usage in an coming year.

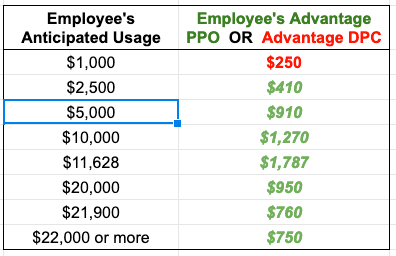

As the image above shows, Nexera reported $5,000 per year is as an average utilization level for an employee member of the district; an employee expecting $5000 in utilization can gain over $900 dollars by rejecting Nextera. Every penny of that advantage for the employee comes out of the employer’s hide — and then it shows up in Nextera’s table as a Nextera win. A employee with moderately heavy utilization – but still only about twice the average and still far short of her mOOP— might even hit the jackpot of shifting $1787 from her pocket to the employer, simply by rejecting Nextera. Heavier utilizers, those who surpass their maximum out of pocket – will all gain at least $750 by rejecting Nextera.

This benefit design pushes a large swath of risky, costly patients away from Nextera.

But that tells only part of the story. As if pushing unhealthy patients away by increasing cost-sharing does not do quite enough to steer low risk patients to Nextera, a difference between employee share of premiums specifically drives children into the Nextera cohort. A Nextera employee pays $1600 less per year to add coverage for her children than she would pay to have the same kids covered in the non-Nextera plan. About 24% Nextera population is under 15 years old, versus about 13% for the other group. On the other hand, those 65 and up are four times more likely to reject Nextera. The overall Nextera population is about 6.5 years younger on average as a result.

And notice that even after Nextera starts with a younger, healthier pool, those who elected Nextera will face vastly more cost-sharing discipline under their benefit plan than their PPO counterparts. They can be expected, in aggregate, to consume less. They will have lower “induced utilization”. Per the Milliman team, this should be considered by those evaluating the impacts of DPC.

If the employer’s claims costs are adjusted for both (a) the youth and health risk difference between Nextera and non-Nextera populations, and (b) the confounding effect of induced utilization, Nextera’s cost savings brag will likely be shredded.

Indeed, we have good reason — from from Nextera’s own previous study of the exact same clinic — to suspect that a population risk-adjustment of more than a third is quite likely. Adjust the Nextera brag by that third and the savings will not simply vanish, they will turn into increased costs.

In this regard, moreover, a 2016 Society of Actuaries commissioned report, explained that all the available risk adjustment models failed to completely compensate for adverse selection. Ironically, their selection of a “highly adverse” population for evaluating the performance of the major risk adjustment methodologies was one with a claims cost history that was 21% higher than the average. In Nextera’s earlier self-study of the same clinic, the prior claims cost history of the non-Nextera cohort was an astronomically adverse 43% higher than the Nextera cohort.

Update: October 22, 2020. So now Nextera has published an extended account of its SVVSD program. It’s here here.

(It was “there” before Nextera sent down the rabbit hole its claim that a Johns Hopkins research team had done the cherry-picking analysis; that claim persists in this slide.)

A video version, here.

I initially replied here , here , here and here.